During Ubisoft’s recent earnings report and subsequent Q&A sessions, CEO Yves Guillemot outlined the company’s strategic focus for the foreseeable future: open-world action-adventure games and live-service titles. This dual focus aligns with Ubisoft’s ongoing investment in a robust production pipeline designed to deliver consistent content year after year.

Guillemot emphasized that Ubisoft has been “investing significantly” in these two verticals, which include flagship franchises like Assassin’s Creed and Far Cry for open-world action-adventure games, and Rainbow Six Siege and The Crew Motorfest for live-service experiences. “That’s what we want to deliver year after year,” he stated, highlighting the company’s commitment to these genres.

One of the most anticipated releases in Ubisoft’s pipeline is Assassin’s Creed Shadows, set to launch on March 20, 2025, for PC, PlayStation 5, Xbox Series X|S, and macOS. Guillemot revealed that pre-orders for the game are “solid” and are tracking in line with those of Assassin’s Creed Odyssey, the second most successful entry in the franchise. Despite multiple delays, the game has generated significant interest, though it has also faced controversy.

Looking ahead, Ubisoft has big plans for 2026, particularly for Rainbow Six, which is expected to play a key role in the company’s strategy. Other confirmed projects include Anno 117: Pax Romana and The Division: Resurgence for mobile, both slated for release in the coming year. Guillemot noted that more details about Ubisoft’s 2026 lineup will be shared in May, coinciding with the company’s next earnings report.

While Ubisoft’s focus on open-world and live-service games is not new, the company has faced challenges in the live-service space. Titles like XDefiant and Hyper Scape were shut down relatively quickly after launch, and Skull & Bones has struggled to gain traction. Despite these setbacks, Ubisoft remains committed to the live-service model, with The Crew Motorfest reportedly outperforming its predecessor, The Crew 2, in terms of player retention and monetization.

Guillemot also addressed Ubisoft’s ongoing cost-reduction program, which has led to layoffs and studio closures. He described these changes as “difficult but necessary” and mentioned that the company is undergoing a formal review process to improve its financial outlook. One potential scenario involves a deal with Tencent, though no specifics were provided.

In summary, Ubisoft’s strategy for the coming years revolves around doubling down on open-world action-adventure games and live-service titles. With high-profile releases like Assassin’s Creed Shadows and ongoing support for Rainbow Six Siege, the company aims to stabilize its position in the gaming industry. However, the success of this strategy remains to be seen, particularly in light of recent challenges and controversies.

===

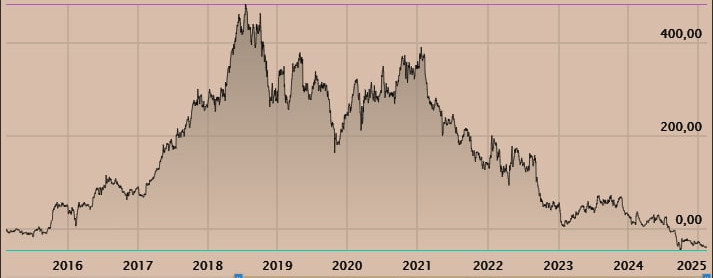

Ubisoft’s current market capitalization is approximately $1.78 billion [februari 2025], representing a significant decline of 85% [since January 2021]

Analysts have a mixed outlook for Ubisoft:

There is a considerable difference between the current price and the average price target set by analysts, indicating potential for value appreciation.

However, over the past 12 months, analysts have regularly revised their earnings expectations downward.

The overall consensus among analysts has deteriorated significantly in the past four months.

There are large differences in analysts’ estimates regarding the development of Ubisoft’s activities, indicating low visibility.

Stock Price Development

Here’s a graph of Ubisoft’s relative stock price development over the last 10 years :

[$110.6 on 31 july 2018 — $11.32 on 14februari 2025]

Market Capitalization (billion $)

Year:

2021 — $12.47B

2025 — $1.78B

February 17, 2025

Leave a Reply